If you run an online business or thinking to start one, then your top two choices for online payment solutions are most likely PayPal and Amazon. With nearly 60% market share, PayPal is, of course, the industry leader, but Amazon Pay is right behind it. In this blog, I will compare both the solutions and try to give you some idea of what can be more suitable for you.

Price

There are no startup costs, monthly or termination fee for both Amazon and the standard version of PayPal. However, you may have to pay a monthly fee of $25- $35 for a premium version of PayPal like PayPal Payments Pro or Payflow Pro.

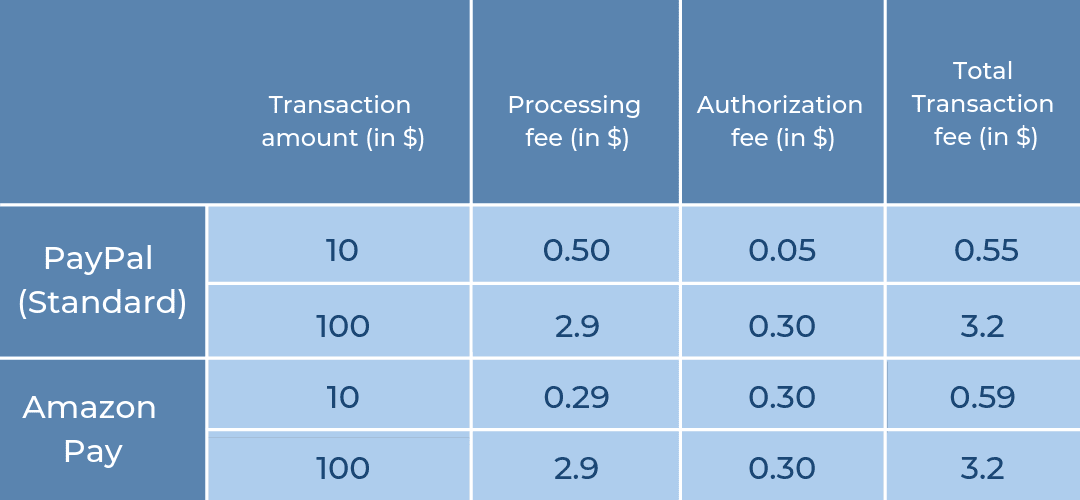

You are charged when a transaction is done on your site through the gateways. These transaction fees vary by country. Here is a brief detail of the transaction fees-

- PayPal - For business in the U.S., you pay 2.9% + $0.30 per transaction while outside the U.S., the transaction fee varies from around 3 to 4.5% of the amount plus a fixed fee based on the currency. Also, you may have to pay more for the micropayments, transactions under $12, that are charged at 5% to 6% + a Fixed Fee based on the currency per transaction.

- Amazon - Amazon payment gateway charges 2.9% + $0.30 per transaction for domestic U.S. transactions, plus tax where applicable. They also charge for Cross-border transactions that are subject to an additional fee of 3.9%.

So, what does this mean? Well, I’ve calculated an example monthly fee for each service to give you an idea of which payment gateway is the most cost-effective. For my calculation, I am assuming your business is based in the US, and you are getting 50 transactions of $10 and $100 each in a month. So, the transaction fee you pay will be:

Now assuming you have 50 such transactions in a month for each amount, so the fee charged for $10 transactions (the total amount you receive is $500 per month) on PayPal will be $27.5, and on Amazon Pay will be $29.5. Whereas the fee you pay for $100 transactions (total amount $5000), on both PayPal, as well as Amazon Pay, is $160.

We can say, PayPal is cheaper if you are dealing in low-ticket items or services. However, do remember that the cost calculated here is from a US perspective and may vary from country to country, so be sure to confirm and estimate the cost in your country before committing.

Features

1. Currencies Supported

PayPal is available in more than 200 countries and regions, and supports 25 currencies, while Amazon Pay is currently available only for merchants with a place of establishment in around 16 countries and supports nearly 12 major currencies.

2. Checkout Process

The standard option takes buyers through PayPal’s site which means you don’t have full control of the checkout process, while Amazon Pay has a more streamlined checkout experience where the customers never leave your website during the process. This feature is available only in the Pro versions of PayPal that also allows you to fully customize the checkout experience on your site, great for brand conscious businesses.

3. Payments

With PayPal, anyone with a credit card can pay even if they don’t have a Paypal account. While for Amazon payments, the customer should have an account with Amazon, which is not an issue, as most people have an Amazon account these days. As per a report, Amazon had 310 million active customer accounts in early 2016 and the number has grown significantly ever since.

When it comes to payment forms, Amazon accepts all major credit and debit cards. But with PayPal, major credit cards are accepted as well as bank accounts, eChecks, and PayPal balance.

4. Online Invoicing

For the businesses who find it hard to keep track of the invoices, PayPal allows the users to create online invoices with free built-in templates and email them to the customers. There are no fees for creating and sending invoices, no setup charges, no monthly fees, and no cancellation charges. You are only charged when you receive payment online. Amazon Pay doesn’t mention providing any such feature.

5. Security

Being trusted brands, both PayPal and Amazon take security seriously.

However, there are many instances when even the slightest suspicion leads to the locking of the PayPal account. Also, if you have a high number of chargebacks and customer complaints as a seller, PayPal may limit your account or may hold payments for up to 21 days in case there is a problem with your transaction.

This can even happen to sellers who deal in certain kinds of materials such as electronics, gift cards and event tickets which are subject to higher levels of fraud. Similarly, Amazon Pay might not work for you if you deal in any of the restricted items like weapons, tobacco products or counterfeits. So do your homework and check out the Amazon acceptable use policy and PayPal policy before you use any of them for your site.

Installation Process

PayPal payment gateway integration perhaps is the easiest to configure while Amazon Pay payment gateway integration may take a little programming knowledge unless you use good Amazon Pay Integration Plugins.

Support

If you have any questions that are not covered by the help page on Amazon, you need to first raise your query via a quick web form, the Amazon support team gets in touch with you via call, chat or email, whatever mode you prefer. PayPal also offers virtual assistant, as well as free phone support to the merchants.

Final Thoughts

Both payment platforms offer merchants an easy way to get paid and offer shoppers an easy way to send a payment. But, which payment gateway to choose? The answer is subjective. It depends on your business location and the markets you target around the globe. However, payment gateways aren’t mutually exclusive– you can always use more than one gateway to give your customers multiple payment options, which is more likely to get them over the line.

In fact, according to a study, 26% of US online shoppers have abandoned an order in past year solely due to a “too long/complicated checkout process” while 6% abandoned due to “lack of enough payment methods”. You can overcome both of these issues by using one or more payment gateways on your site.

Of course, this is just my opinion, and I’d love to hear your thoughts on this. Which is your favorite payment gateway and why? Share your thoughts in the comments section below!

Please find more about nopCommerce (the best platform to lauch your online store) here.

Author: Yamini Baghel

Yamini is a writer and loves sharing her thoughts and tricks with the readers. Currently, she works as a copywriter at Seurata.com.