Multiple Tax (PST,GST,HST)

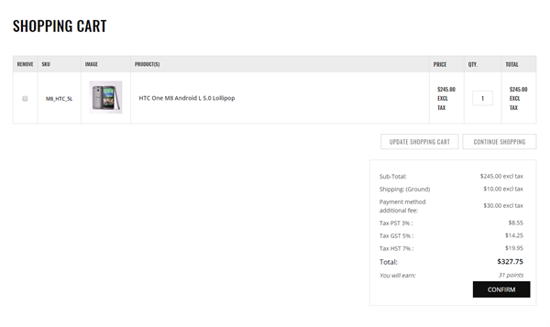

This plugin supports PST, GST, HST separate taxes for specific countries/state/zip. It adds two or three-level taxes in default nopCommerce. Taxes can be applied to products, shipping rates, payment method additional fees.

$19.00

Versiones soportadas:

4.10

Creado:

noviembre 07,2019

Última actualización:

octubre 14,2022

Descripción

Features

- Support two or three taxes over products, shipping rates, Payment method additional fee.

- Support country/province/tax category based tax.

- Support PST, GST, HST taxes.

- Show separate calculations for each tax.

- Save PST, GST, HST labeled tax rates after order complete.

- Show separate tax calculation in invoice PDF.

- Show labeled tax rates for excel export.

- Show separate tax labeled at email.

- Customers can see separate tax labels at order details.

- Customers can see separate tax labels at download PDF and print PDF.

- Store owners can use the same tax amount for different states for the same tax category.

- Store owners can use the same tax amount(Percentage) for the different state for the same tax category.

A form of sales tax applied to purchases in some Canadian provinces. Some provinces charge their Provincial Sales Tax (PST) as a "value added tax" while others use a "cascading tax." Value added taxes are calculated on the value of the item being bought without taking the Goods and Services Tax (GST) into account. Cascading taxes are calculated after the GST has been applied, effectively applying a tax on top of a tax. Some provinces have done away with a PST and have moved towards a Harmonized Sales Tax (HST) which combines the GST and the PST.

Setup

- Download plugin extension.

- Go to Dashboard » Configuration » Local plugins and upload the plugin zip folder.

- Install the plugin.