As we look back over the last 18 months, it has become pretty apparent that the COVID-19 pandemic has radically altered how most of us shop for goods and services. Restrictions on movement and the closure of non-essential businesses saw considerable boosts in sales for established online stores, whilst many traditional high street shops were scrambling to update their operations to remain relevant.

“So far, so obvious”, you’re probably thinking.

But whilst it’s true that the pandemic was a massive catalyst for change in many sectors of the global economy, it only served to accelerate trends and consumer preferences that were already on the rise.

Using ECOMMPAY’s survey data and payment processing expertise, let’s now dive in and take a look at some of those consumer trends, focusing specifically on changing payment preferences, to help ensure that your shopping cart and payment processor is up to the challenge:

Modern Consumers are a Demanding Bunch

ECOMMPAY’s first survey finding should come as no real surprise, but it’s still one of the most important trends to keep in mind:

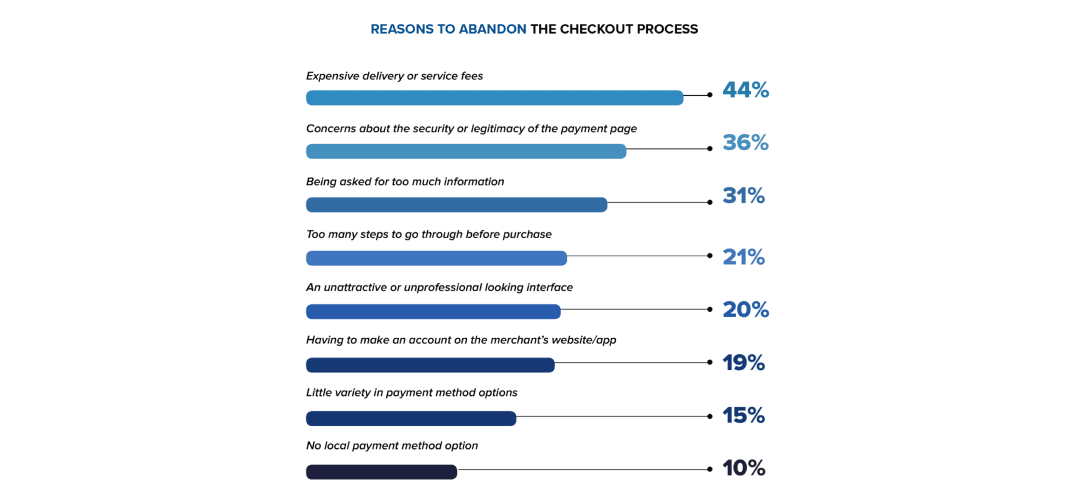

We’ve always known that the aesthetics of a checkout page have played a huge part in the consumer decision making process, and the survey data reflects that trend: 20% of all respondents said that they would abandon a shopping cart if the interface looked unattractive or functioned poorly.

Closely tied to this statistic, a whopping 36% of consumers said that they would ditch the checkout process entirely if they had concerns over the security or integrity of the web page.

When asked for the reasons they would abandon the checkout process, consumers cited:

The takeaway? Perception is everything when it comes to online shopping, so make sure your shopping cart and checkout pages are professional and secure. With nopCommerce there are opportunities to improve your ecommerce store’s checkout that is secure and with attractive UX/UI design. One-page checkout and various payment gateways increase sales volume.

E-wallet Use is Skyrocketing

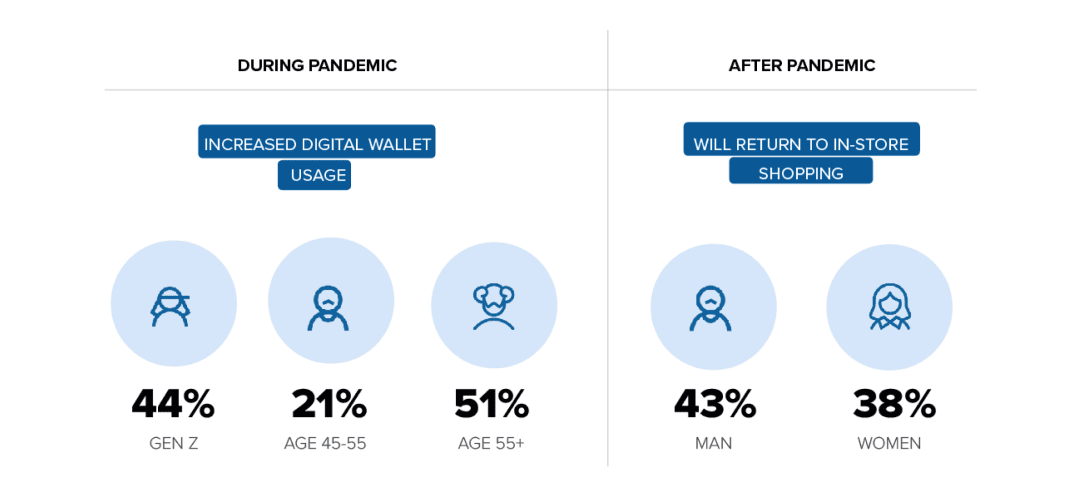

If your products are positioned towards the younger end of the market, or “Generation Z”, it should come as no surprise that digital wallet use is on the rise. 44% of this consumer segment increased their e-wallet use during 2020, and could well be the first generation to embrace a 100% cashless economy.

Like so many other technologies, now that digital wallets have become more commonplace with the younger generation, there’s a natural trickle-down effect to older segments of the market: 51% of 55+ aged consumers increased their use of e-wallets in 2020, with one in five (20%) of those surveyed admitted to using a digital wallet for the first time in 2020. Thus, compatibility of e-wallets with nopCommerce and adding them as payment methods expand the customer base of ecommerce stores.

Messenger App Payments are Going Mainstream

You may not be aware of the growing trend for messenger app payments, but from 2020, they’ve begun to contribute increasingly to the retail landscape.

Telegram, the privacy-focused messenger app, became the most downloaded (non-gaming) app in January 2021, with a staggering 63 million downloads in a single month.

Telegram was one of the first messenger apps to come with a built-in method for making and receiving payments. Although apps like WeChat and Facebook Messenger also make it possible to pay for goods and services, Telegram seems to be taking the lead for ease of use and features:

- Payments are handled by bots — third-party applications that run inside of Telegram, functioning like real humans.

- 40% of Telegram users already use bots to perform automated tasks, and the technology is becoming increasingly popular and easy to use.

- Companies can set up business channels on the platform, where customers can pay for goods and services using a payment method they’ve stored with a payment bot.

Apps like Telegram not only offer new and exciting ways for your customers to pay, they’re also fantastic marketing channels in their own right, so you should definitely try to maintain a presence on these increasingly popular apps.

Pay-by-Bank use is Surging

Open Banking or Pay-by-Bank is a relatively new payment technology that enables customers to have full control over their financial data. Open Banking allows instant, direct cash flow from one bank account to another and already links hundreds of European and UK banks.

Open Banking technology eliminates chargebacks, is fully compliant with PSD2, and can help to increase conversions by providing a smooth, secure and more customised payment process.

Although knowledge about open banking is still low in many industries, the technology is forecasted to have a market value of $43.15 billion by 2026, bringing greater competition and innovation to financial services, which in turn will lead to better products to help users manage their money.

The Usual Suspects Continue to Dominate Consumer’s Lives

These days, the likes of Google and Apple have an almost complete stranglehold on the smartphone industry. That means their integrated payment systems (Apple Pay and Google Pay) will continue to dominate the payment landscape, along with established payment providers like PayPal.

As more people embrace smartphones and 100% digital transactions, those tech giants will only continue to grow in popularity: We’ve already seen a 100% growth in Google and Apple Pay payments between 2018 and 2020, and that trend continues at a rapid pace.

As well as digital wallet payments, mobile in-app revenue has also increased threefold over the past five years, accelerating from $60 billion in 2015 to over $180 billion in 2020.

The takeaway? Your customers could potentially be paying solely by smartphone in the near future (if they aren’t already), so you need to ensure your checkout process provides a smooth and seamless mobile-first experience.

Buy-Now-Pay-Later is Becoming More Widely Accepted

Buy-now-pay-later has always been an enticing offer for consumers, but ECOMMPAY notes that interest from businesses in this payment option is intensifying as more efficient ways of implementing pay-by-instalment purchases become available.

Adding buy-now-pay-later offers to your checkout process could help you to enjoy a higher average spend per customer, as well as improved conversion rates and increased brand loyalty. Stores on the nopCommerce platform may already benefit from this payment option.

Fraud is on the Rise, along with Increasingly Advanced Technology to Fight It

ECOMMPAY’s research uncovered that 21% of British shoppers had experienced more fraud during the COVID-19 pandemic, via a mixture of SMS, telephone, online or even in person.

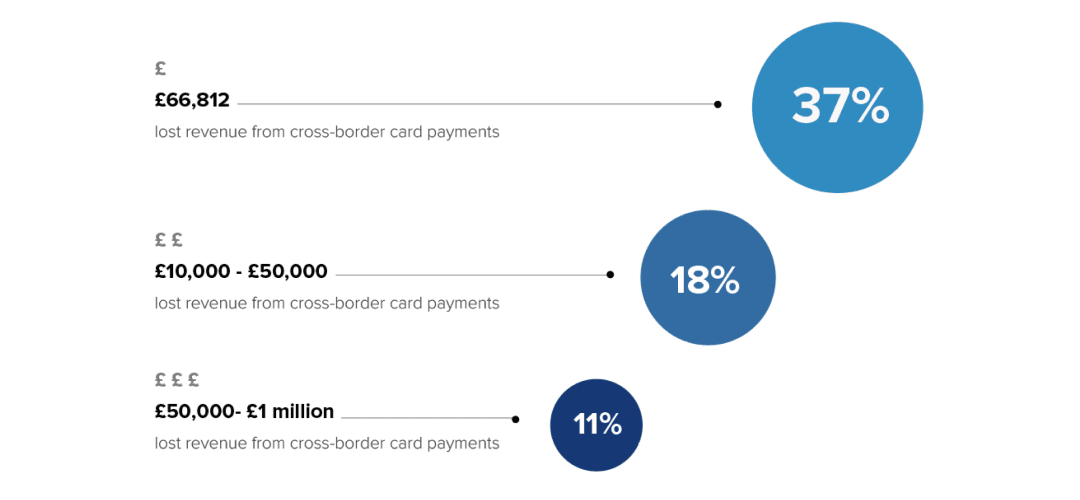

In addition to consumer fraud, businesses themselves also fell prey to scams and fraudulent activity at increasing rates: According to the survey, 37% of UK businesses have lost money due to online fraud tactics like chargebacks during 2020, showing that as the economy heads towards an all-digital future, the scammers will follow along for the ride.

The solution to this problem requires increasingly complex anti-fraud systems based on machine learning and joining forces with experienced risk control experts. AI and manual monitoring will form the cornerstone of a well thought out anti-fraud strategy as companies take more of their business online. Authentication extensions of nopCommerce, as well as PCI DSS compliance allow customers and businesses to securely process transactions and keep off any threats and risks.

Summing up

It’s no secret that consumer habits and payment preferences have been evolving for quite some time now. Still, ECOMMPAY’s latest survey confirms what we already knew: The COVID-19 pandemic has accelerated attitudes towards digital wallet usage and online shopping in general, creating a radical departure from the high street that’s undoubtedly here to stay.

Businesses must take note of these shifts in consumer preference and ensure that their payment processes align with users' preferred payment methods, prioritising checkout page efficiency and professionalism to ensure that shoppers feel comfortable that payments are being processed safely and securely.

About ECOMMPAY

ECOMMPAY provides tailored payment solutions to grow your retail business in a rapidly changing digital economy. Their payment ecosystem offers over 100 local payment methods, as well as a simple, scalable and secure way to receive payments and manage refunds and returns – all with a single click!

In March 2021, ECOMMPAY collaborated with Censuswide to conduct two surveys, asking UK business leaders and end-users about their current behaviours, payment preferences and challenges. This article draws from the conclusions of those surveys.