PayPal Commerce (the official integration)

Boost conversion with PayPal.

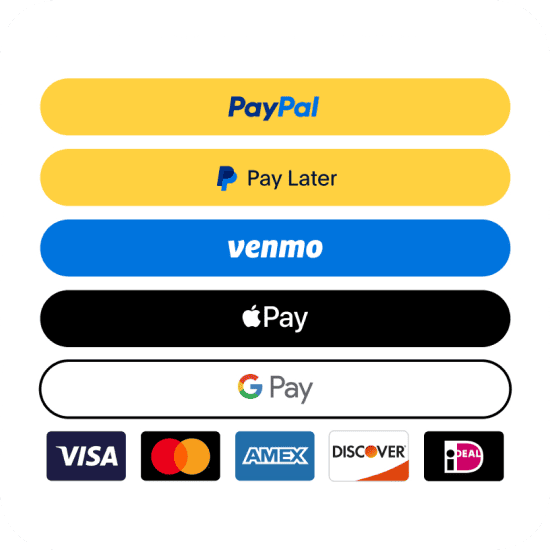

PayPal’s brand recognition helps give customers the confidence to buy. Your all-in-one checkout solution can offer PayPal, Venmo, Pay Later options, card processing, local payment types, and more — all through a single PayPal integration.

46% higher checkout conversion with PayPal1.

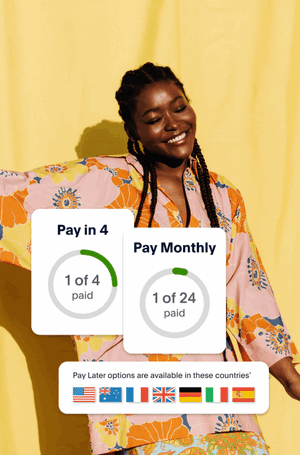

Help drive sales with Pay Later.

Allow customers to pay later while you get paid upfront — at no extra cost to your business. Turn on Pay Later messaging to automatically present the most relevant Pay Later option as your customers browse, shop, and check out. With repeat customers making up 66% of all US Pay Later transactions2, it’s no surprise that Pay Later can help attract and retain customers.

35% increase in cart size with Pay Later offers when compared to standard PayPal transactions3.

Tap into 92 million active Venmo accounts.4

Venmo is already part of your integration — at no additional cost. Gain appeal to Venmo customers by letting customers pay for purchases the same way they pay their friends. And help bring more visibility to your business with a payment method customers can easily share. Users spend 2x more annually on online purchases than other online buyers5.

Go global. Make it local.

With country-specific payment methods, you can reach international customers while making your business feel local.

Help grow your international sales by accepting payments in over 200 markets and 130+ currencies where PayPal is available

Accept Apple Pay and Google Pay.

Apple Pay and Google Pay are part of PayPal’s all-in-one solution so you won’t have to juggle multiple payment providers.

Take charge.

Add all major debit and credit cards to your all-in-one solution. It’s easy to manage and we handle the processing.

Make repeat purchasing easy.

PayPal enables you to securely save your customers’ payment methods, including PayPal, Venmo, Apple Pay, Google Pay, and credit and debit cards, providing a quick and easy checkout experience.

Create a fast checkout

With their payment info saved, customers can make repeat purchases in just a few clicks, helping you to improve checkout conversion.

Offer subscriptions

Saving a customer’s payment method allows you to set up recurring payments and charge your customer on a scheduled basis.

Reduce card declines

Card data can be kept current with account updater services to automatically update expired card information to help capture every sale.

Elevate security

Customers' payment information is stored securely by PayPal, helping you ensure compliance and minimize risk.

Package tracking.

Give your customers real-time shipping information right in the PayPal account without the need to visit the online store.

Cut down on disputes with package tracking.

PayPal’s Package Tracking can provide live updates and notifications to track your shipments from the point of purchase to your customers door. Reduce “Item Not Received” disputes by as much as 80% with built-in package tracking for PayPal and Pay in 3 transactions.6

Accept in-person payments.

Accept card, contactless, and mobile payments in your store with PayPal’s Zettle point of sale (POS) system. With the tools to seamlessly bring together your online and in-person systems, Zettle can help track inventory, analyze sales, and expand your business.

Learn more: https://www.nopcommerce.com/paypal-zettle-pos

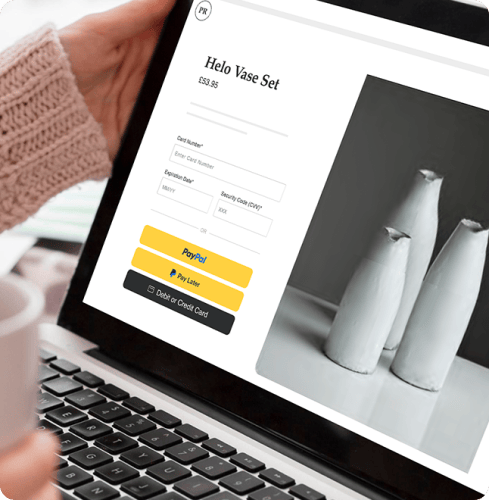

Fewer clicks, less friction

Streamlined checkout helps reduce cart abandonment, drive conversion rates, and encourage repeat business. With PayPal, customers can use their saved billing and shipping info to checkout faster — on any device.

More reasons to offer PayPal.

PayPal’s size, scale, and payments volume allows for strong global relationships to help you better serve customers, minimize costs, and help drive sales.

PayPal Fraud detection

Save time and money by letting PayPal help you handle the risk of fraudulent transactions with the fraud detection, chargeback8, and Seller Protection9 capabilities (on eligible transactions). AI technology works hard to monitor all of your transactions — so you can focus on what matters most.

Easy setup:

- Download the plugin archive.

- Go to admin area > configuration > local plugins.

- Upload the plugin archive using the "Upload plugin or theme" plugin.

- Scroll down through the list of plugins to find the newly installed plugin. And click on the "Install" button to install the plugin.

- You can create a PayPal account directly from the plugin configuration page.

1Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022-March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions & 1,001 non-PayPal transactions.

2 Based on PayPal internal data from Jan 2022 - Dec 2022.

3Globally, Pay Later AOVs are 35%+ higher than standard PayPal AOVs for SMBs. Internal Data Analysis of 68,374 SMB across integrated partners and non integrated partners, November 2022. Data inclusive of PayPal Pay Later product use across 7 markets.

4Focus Vision, Commissioned by PayPal. October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers' financial habits, purchasing behaviors and perceptions of Venmo as a payments tool.

5Edison Trends, commissioned by PayPal, April 2020 to March 2021. Edison Trends conducted a behavioural panel of email receipts from 306,939 US consumers and 3.4+ M purchases at a vertical level between Pay with Venmo and Non-Venmo users during a 12-month period.

6Based on PayPal internal data from December 2023 to March 2024 in DE, FR, UK, ES and IT. Merchants=50 ; who sending trackers on 40% or more of their branded XO transactions; Dispute Type = Item Not Recieved (INR), UnAuthorized (UnAuth). These are SMB merchants but the proof-point would also be applicable to LEs. Applies to all merchants who ship physical goods, not including digital goods/services merchants.

7CR (Consumer Reports), "Buy Now, Pay Later Apps Are Popular, but Are They Safe?" Consumer Reports , May 25, 2023.

8Chargebacks that are not related to fraud or item not received (INR), such as broken item, significantly not as described (SNAD), refund not processed, and duplicate charge, are not protected by Chargeback Protection. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments.

9Available on eligible purchases. Limits apply

One of the best integrations.