In the thriving world of eCommerce that sees over three hundred million shoppers in the U.S. annually, the opportunity to capitalize is not only immense for brands and companies but fraudsters and bad actors.

Now more than ever, crafty and intuitive fraudsters use stolen cards, complex attacks, and fake details to steal from online websites and storefronts; real threats that cost eCommerce stores and companies billions in losses each and every year.

Ridding attacks, and averting losses that companion such threats, require a tuned and mindful strategy.

Join us as we show how to fortify your digital defense; these tips help negate threats, and make it easier to keep fraudsters at bay where they belong.

If you need ways to detect and prevent chargebacks, fake accounts, and malicious users, guides and services at IPQS will prove critical to your digital defenses!

What are the most common threats to eCommerce?

As online scams and payment fraud rise, so does the need for solutions that can readily combat them.

From fraudsters who use emails as a means to dupe naïve recipients into sharing sensitive info to bad actors who work tirelessly to take over and hack into customer accounts, there is no shortage of threats faced by eCommerce companies today.

As such, it is vital to put an eCommerce chargeback protection solution in place, and one like IPQS that can help negate chargebacks for popular shopping carts.

With over a billion user events logged each day, IPQS has a rich source of data that allows to score the risk of emails, transactions, phone numbers, and credit cards so you know which are safe to engage.

Protect from fake emails & phishing attacks

Emails are a great way to stay in touch with clients or partners but they are used by fraudsters to steal data.

From sharing links to forms or pages that phish data to taking over email accounts to impersonate the real account holder, fraudsters and the threats they pose are on the rise and show no sign of slowing.

This is a threat and is why most use API-driven, email validation solutions are proudly provided at IPQS.

One simple but useful way to secure your data and network is to only engage emails you know are legit.

In the event you or an employee are tricked into dolling out sensitive data, issues will likely follow so be sure to check the address of sender emails to verify you are talking to the right person.

You may also want to use an email verification service, as offered here at IPQS, and coach employees on what to look out for.

Deploy two-factor authentication for a layered and fortified security approach

Accounts with no 2FA are vulnerable to ATO attempts, and the theft of sensitive info that often follows.

If accounts do not use 2FA, hackers can crack or guess the password and gain unauthorized entry to it, at which point they can see sensitive data like names, addresses, and credit card numbers or payment information.

User accounts with no two-factor authentication are easier for fraudsters to hack into as there is no step in place to verify the login is from the real account owner – so offer this feature to users as this will give both them and you better security, protection, and invaluable peace of mind.

Use the power of strong passwords

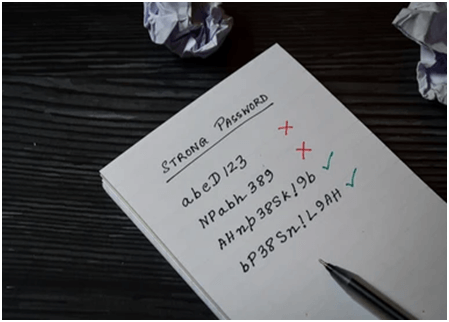

On the sign-up page, remind users how vital it is that they use a strong login – even go as far as to share tips for creating a fool-proof password, and require them to use a mix of characters and special symbols.

Those with an account on your site may make orders or give details like addresses or credit card numbers.

As such, they need strong passwords so fraudsters are not able to easily crack or guess them. And as always, give account holders the ability to enable 2FA as this is what they require to prevent unauthorized access.

Invest in fraud detection software

Ensuring the safety and integrity of all you worked hard to build, which means ensuring customer data is safeguarded, requires a solid fraud detection and prevention solution that denies or approves payments based on risk factors.

By deploying fraud detection software, you can save time, ward off threats, and stay steps ahead of fraudsters who are no match for the tough barriers we put up.

If you think fraud is taking place or an attack is in the works, or if you are seeing a rise in chargebacks or fake accounts, swiftly resolve the issue with the help of IPQS that offers real-time, fraud prevention and detection monitoring so your company and transactions run smoothly.

Their API-driven solutions make it easy to keep bad actors at bay, and we run quietly behind the scenes while you enjoy blissful operations.

Mitigate the risk of chargebacks

Of all the things you want to reduce as a company, chargebacks are likely first atop your list of priorities.

As you likely know, these take place when a person disputes a charge with their financial institution, and they can lead to costly fees, wasted resources, and a decline in reputation with your payment processor.

If payment fraud or chargebacks affect your business, try this eCommerce fraud prevention solution that gives real-time fraud protection and risk-scoring with no false-positive results, so you will know with full certainty which charges are safe to process (any that are not deemed safe will be automatically denied).

Build a vigilant team

By training and educating your team on signs of fraud and attacks, you can have more eyes on watch for threats and help avert them before they unfold. Use a fraud prevention solution, and inform employees to look out for signs of fraud, which include but are not limited to:

- Requests for a package to be shipped quickly.

- Inconsistencies in the billing and shipping details.

- Multiple orders attempts in which the payment fails.

- Requests for a package to be sent to a different address.

Prioritize data security

A single weak link can tumble it all, so make sure data privacy and protection are atop your priority list!

To protect customer data from prying eyes and bad actors that go great lengths to get sensitive info, use firewalls, encrypted payment gateways, and an anti-fraud data protection service like IPQS that helps to keep client data secure – you also want to keep your software, website, and systems up to date to cover exploits or loopholes.

Types of eCommerce fraud

Fraud is a high risk and nuisance for many industries and companies, and eCommerce is no exception.

Follow us below as we cover the most common types of fraud faced by eCommerce companies today.

1. Card testing fraud

Card testing fraud is when a fraudster runs a small charge on a stolen credit card to see if it is active.

This is of grave concern as if a compromised card is used to make a purchase on your site or platform, you will inevitably face a chargeback and be at a loss for any products or services that were rendered.

To combat card testing fraud and attempts, use a solution, like the IPQS transaction fraud detection API, as this will screen and risk-score entries so you only process transactions that are secure and legitimate.

2. Chargeback fraud

This is a nightmare to deal with, and is a form of fraud that lost companies well over $20 billion in 2021.

Chargebacks may take place due to a company error or a customer who is not satisfied with a service or product, but at times, one may be opened by a customer (fraudulent actor) to get a refund for products they plan to steal and not return – it is such an instance in which a case of chargeback fraud is unfolding.

To negate chargeback fraud, use a chargeback fraud prevention solution that lets you risk-score cards so you know which ones are safe to charge, based on if any signs of past abuse or fraud are linked to them.

3. Refund fraud

Also known as Return fraud, refund fraud costs retailers over $20 billion in losses each year and is one of the largest threats faced by eCommerce brands today.

This type of fraud is when a bad actor gets a refund for a product they do not return, they may even chargeback the amount and keep the items they received.

4. Account takeover fraud

This is when a hacker gains unauthorized entry to a customer account with stolen or cracked credentials.

Once in, the bad actor can make purchases or account changes, and may steal sensitive details to place fraudulent online orders.

Simply put, ATO is when a cybercriminal gets control of legitimate customer accounts; some target bank accounts while others may take over email and social media accounts.

From data breaches to social engineering to phishing and malware attacks, hackers use many techniques to get logins to target accounts, and if they do, they can launch against you a range of attacks, including:

- Supply-chain phishing, email is the main way companies stay in touch with clients and partners; fraudsters know this, and is why they may take over a profile as they can defraud customers or supply-chain partners under your name, which can greatly hurt your reputation and credibility.

- BES-type attacks, fraudsters can impersonate the owner of profiles they hijack and bypass email verification requests too so they may gain entry to other accounts owned by the helpless victim.

- Internal phishing, the bad actor hacks an email of an employee to get sensitive info from others on the company team, who are not aware in the least bit they are talking to a hacker.

5. Interception fraud

This is when a fraudster uses a stolen credit card to make an online purchase, what they do is have items sent to the valid billing address linked to the card which lets them bypass security checks that ensure the billing and shipping address align.

Once items are shipped and on their way, the devious fraudster will then try to intercept the goods by:

- Reaching out to your customer support to request the items to be sent to a different location.

- Monitoring tracking updates so they can arrive at the home to intercept the package in person.

- Contacting the shipping company (UPS/USPS) directly to get the package sent to a new address.